Common reasons lawyers close their practices include a medical disability, wanting to retire, a move out-of-state, or a career change. While the specific steps that need to be taken and the time frame involved can vary significantly depending upon the reason driving the closure and the type of practice being closed, the following two checklists cover the basics of what most lawyers will need to think about. If time allows, be prepared for the process to take six to twelve months and sometimes longer because the obligations to protect client confidences, as well as the interests of the client, make closing a law practice more difficult than closing other types of businesses. Finally, note that jurisdictional rules do differ, thus a review of your local rules and ethics opinions, perhaps coupled with a call to your local bar counsel would be well advised early in the process.

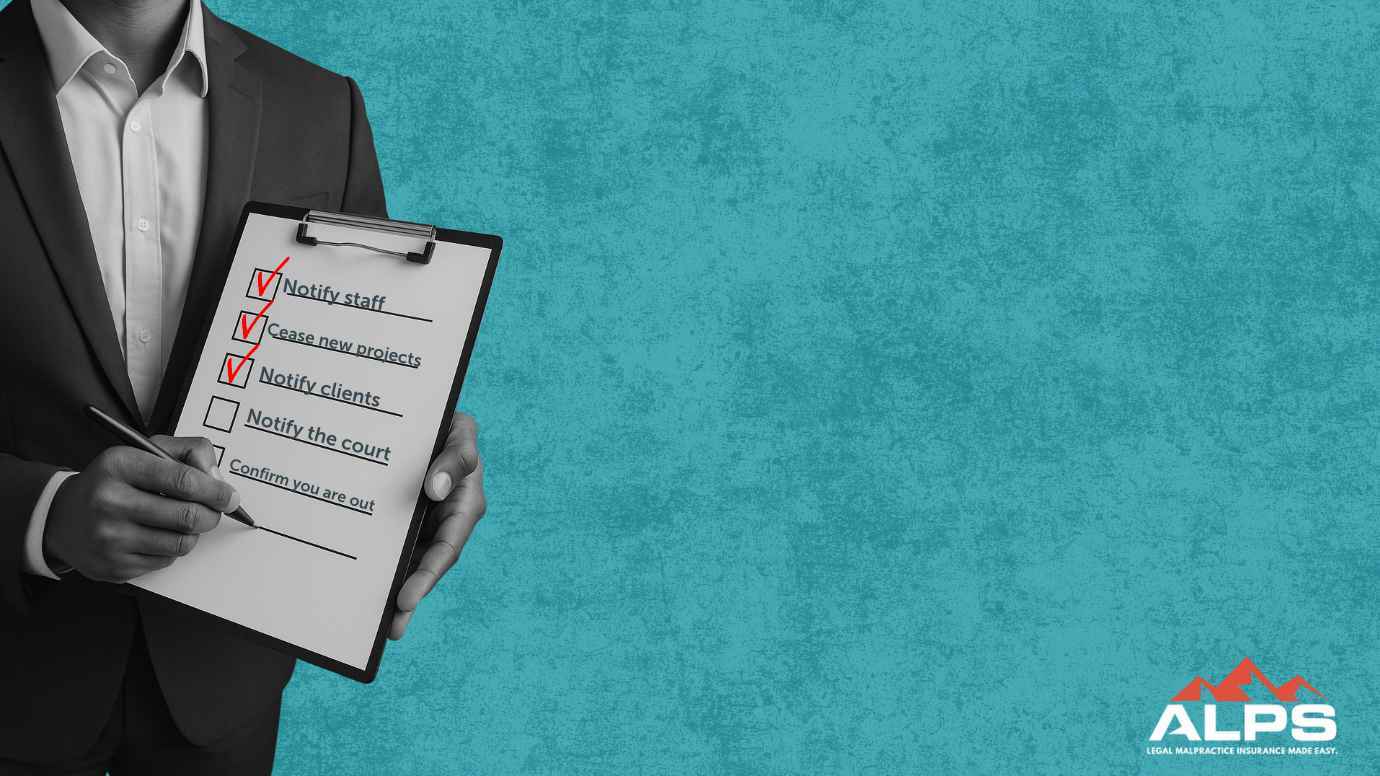

Checklist for Closing Your Practice

- Build out a timeline and assess the status of all active matters.

- Let your most trusted staff know what your plan is as you’re going to need their help in implementing it. Additionally, key staff deserves to know your intentions once you know the date you hope to have the transition completed. If possible, give them a date certain and advise them if you are willing to be a reference for them. After all, these folks need to be able to plan for their transition as well.

- Cease taking on any new matters.

- Bring to completion and close as many active matters as you can.

- Notify all clients of your plans on matters you are unable to complete. This letter should advise them that you are unable to continue representing them and that they will need to retain new counsel. Inform them about relevant time limitations and time frames important to their matter. Explain the ‘how’ and ‘where’ they can obtain a copy of their file and set forth a deadline for doing so.

- Provide active clients with copies of their file and keep your original files. Clients who pick up their files should sign a receipt. Clients who wish to have their file transferred to another attorney should sign an authorization for you to do so.

- Notify the court. On matters with pending court dates, depositions, or hearings discuss how to proceed with each client. Request extensions, continuances, and the resetting of hearings where called for. Send written confirmation of these changes to opposing counsel and your client. Obtain permission to submit a motion and order to withdraw as attorney of record.

- Confirm you are out. On matters before an administrative body or court, pick an appropriate future date to check and confirm that a substitution of counsel has been filed or that your motion to withdraw has been granted and then follow through with checking.

- Notify all clients of your file storage arrangements. Let them know where files will be stored, how they can obtain a copy if ever necessary, and if not previously addressed, set forth your file retention policy. If closed files will be stored by another attorney, obtain client permission to have the closed files transferred and provide contact information for this attorney.

- Closeout your trust account once it has been audited and reconciled. If funds are to be transferred to a new attorney, disburse those funds by making the check payable to the client and the new attorney. Notify the bar that your trust account has been closed and maintain your trust account records in accordance with the rules in your jurisdiction.

- Preserve your books and records. In a number of jurisdictions, RPC 1.15 requires you to keep general and trust account records for at least five full years following the termination of the fiduciary relationship. This information can be preserved in a digital format.

- Review your malpractice policy and contact your carrier in order to understand the options and costs associated with the purchase of an extended reporting endorsement, commonly referred to as a “tail.”

- Notify relevant bar associations and professional organizations.

- Deal with client property still in your possession such as original wills, client corporate books, unclaimed funds, etc.

Checklist for Winding up the Business

- Give notice of termination of all rental or lease agreements.

- Cancel your telephone service and arrange to have calls to your office number forwarded to your home or other number or consider placing an automated message on your office line that will remain active for at least several months post closure.

- Address any confidentiality and file storage concerns with computers and related tech. Prior to donating, selling, or giving away any device, backup all data that you wish to maintain long-term and then wipe the data from every device.

- Notify all vendors and make plans to close these accounts.

- Cancel or change any existing advertisements and legal directory listings wherever possible. Don’t forget about your website and social media presence.

- Meet with your accountant to discuss the dissolution of your firm, obtain tax advice, establish the schedule for preparation of final financial statements, determine what state and federal agencies need to be notified, etc.

- Meet with any lenders to discuss the repayment of outstanding loans.

- Cancel all firm credit cards.

- Determine where and for how long you will need to store your business records.

- Determine where mail and e-mail should go post-closure then notify the post office and make any necessary changes to all email accounts.

- Consider setting up an automated reply on email accounts that are to be closed and placing a static page on your website that announces the closure of your practice along with information about where closed files will be stored.

- Cancel all business memberships and subscriptions to include online accounts.

- Determine the disposition of furniture, fixtures, library, art, etc.

- Make arrangements to have all utilities turned off in a timely fashion.

- Check with your accountant or financial planner regarding retirement plans and rollover options.

- Notify all insurance companies, to include your premises liability and workers’ compensation carrier. Don’t forget to obtain advice on conversion options for health, life, and disability insurance.

- Close the operating account once all outstanding receivables have been collected and all outstanding bills have been paid.

- Dispose of unused office supplies. Schools or charitable organizations would be pleased to be the beneficiary of such items.

- Destroy all unused checks, deposit slips, etc.

- Avoid potential fraud and identity theft issues by responsibly “retiring” your online presence to include your firm’s domain name, website, email accounts, online listings, and social media profiles. This link will take you to a great resource that details what you should be thinking about as well as the steps you will need to take.

NOTE: This material is intended as only an example which you may use in developing your own form. It is not considered legal advice and as always, you will need to do your own research to make your own conclusions with regard to the laws and ethical opinions of your jurisdiction. In no event will ALPS be liable for any direct, indirect, or consequential damages resulting from the use of this material.

Visit https://www.alpsinsurance.com/resources/sample-forms-and-checklists for additional sample forms and checklists.

Mark Bassingthwaighte, Risk Manager

:

Updated on December 5, 2025 | Posted on November 6, 2019

Mark Bassingthwaighte, Risk Manager

:

Updated on December 5, 2025 | Posted on November 6, 2019