Why It’s Important To Be Able To Say "No"

Some people seem to struggle when it comes to saying no. Perhaps they view it as requiring them to be confrontational and confronting someone can be...

We've crafted solutions tailored to your firm

The world of insurance for law firms can be confusing, and difficult to navigate. We've created this glossary because these common insurance terms should be easy to understand.

5 min read

Mark Bassingthwaighte, Risk Manager

:

Updated on January 26, 2023 | Posted on January 5, 2022

Mark Bassingthwaighte, Risk Manager

:

Updated on January 26, 2023 | Posted on January 5, 2022

Back in the 80’s, Wendy’s aired a commercial that has remained a personal favorite and can still bring a smile to my face to this day. Here’s the gist of it. An elderly woman with two cohorts in tow are in a burger joint. This woman lifts the top of a very large fluffy burger bun only to discover a tiny little burger patty sitting in the middle of this huge bun. This prompts one of her curmudgeonly cohorts to loudly exclaim “Where’s the beef?” The perhaps not-too-subtle message of this commercial was that employees working there had no problem serving puny burgers on huge buns with a side of cavalier attitude, but rest assured this would never happen at a Wendy’s. At Wendy’s, you would always get a big meaty burger served on a big, tasty bun. That ad was a homerun.

So, what does an old Wendy’s commercial have to do with the practice of law?

Plenty. It’s about building and maintaining a reputation. Quality control processes help you get there. For Wendy’s, they wanted to be known for consistently delivering a big, tasty burger. They made a promise and then consistently followed through because they developed very effective quality control processes at each of their locations. For a law firm, when a new matter is taken on a lawyer is making a similar promise: to deliver the promised product or service in a timely and thorough manner. The interesting question for you, however, is this. Does every attorney at your firm consistently follow through on his or her promise with each and every client? Remember, everyone’s reputation is in play with every promise made.

I’m not quite there yet, how about an example?

Sure. A small law firm had a wealthy client with a number of business interests. One day this client happened to stop by unannounced. He simply wanted to drop off a small file with his attorney, who was the founder of this firm. The stated reason for doing so was that he was cleaning up his office and he wanted to keep all his legal files in one place. He stated the file concerned a debt he was owed, but he also went on to say he didn’t think he would ever do anything about it. The attorney accepted the file, and it was shortly filed away with all the other files belonging to this client. The attorney had intended to review the file beforehand but due to other priorities and given the client’s statement, that review never happened. After more than a year had passed, this attorney finally came to learn two things. First, her client had recently died; and second, while the now deceased client never expressed a desire to pursue collecting on that outstanding debt, his executor did desire to do so. The attorney was instructed to pull the file and start taking whatever legal action was necessary. Unfortunately, after the file was pulled and reviewed, this attorney suddenly realized that a critical deadline had passed on her watch. The debt was no longer collectible.

How would a quality control process have prevented this from happening?

In the absence of a quality control process, how would you know if there’s a file just sitting in someone’s file drawer, or a reminder note to look at a file that happens to be buried under a mountain of papers? In either case, the matter is too easily completely forgotten about, which is exactly what happened here. If one of this firm’s quality controls happened to have been a formal file review process, then the subject file would have been reviewed well in advance of that critical deadline passing. The attorney would have had the opportunity to not only discuss the legal consequences of allowing that deadline to pass, but also to document the client’s decision to either preserve his rights or to do nothing about it.

What does a formal file review process look like?

There is no one standard or correct way to conduct file review. All I can say is it needs to be a mandatory process that seeks to ensure that any legal work accepted by any firm attorney will be completed in a timely and thorough manner. That said here are two basic approaches that can be tweaked to fit the needs of your firm:

For the first, consider instituting a strict policy that provides that no active file can be filed away by anyone without a future date in the calendar or tickler system. If no other date is already in the calendar or tickler system within the next 30 to 45 days on any given file, place a file review date into the calendar or tickler system for 30 to 45 days out. This will ensure that every file is touched on a regular basis.

Many case management systems are designed to do this automatically and these programs allow you to set the frequency with which you wish to conduct file review. The key to having this process work is that every matter (regardless of the time it will take or the type of matter it is) must be entered into the system. This includes flat fee in-and-out work such as a simple will, a real estate closing, or a small business formation as well as that legal favor for a friend or extended family member. The reason is malpractice claims can and do arise as a result of attorneys forgetting to follow up on some perceived minor matter and their client was harmed as a result.

An alternative approach is to develop a list of active matters that each firm attorney is responsible for. Sometimes this can be accomplished by printing out a list of active files for each attorney from your time and billing program. Be careful, however, because some time and billing programs will not automatically print out the names of files that have had no work done on them during the most recent billing period and that information is exactly what you need to know.

Once these lists are created, each attorney will need to be responsible for his or her own list. In short, they simply need to place a check by each specific matter they touch every time a file first comes across their desk during the review period. If a new file is opened, the responsible attorney will need to add that matter and client name to his or her list. If a file is closed, that matter and name can be crossed off the list. At the end of each review period, a few matters may be unchecked. Make sure these files are located and reviewed as well because the goal is to ensure that every active file is touched at least once during every review period. A designated staff member is often responsible for updating and providing clean copies of all attorney lists at the beginning of each review period.

Is that all there is to it?

Yep, but there’s value in taking it one step further. In addition to making sure every active file is reviewed, consider making sure that every client receives some type of update every review period. At a minimum, reach out to every client whose matter has had no activity occur on it during the review period. Place a call or send an email even if nothing has happened. Clients tend to appreciate the brief update and this could help limit the number of incoming calls from clients who may begin to fear that things have stalled after there has been no contact for a period of time.

It if helps obtain buy-in, don’t use the term “file review process.” Refer to the entire process as “a client matter review” process. Make this a client-centric process. After all, the whole point is to make sure every client knows that their attorney is following through on the promise to deliver the product or service in a timely and thorough manner. This is how great reputations get built, one client at a time.

While there are other quality control procedures you could implement at your firm, a client matter review process is one that sits squarely at the center of quality control because it seeks to prevent a matter from falling through the cracks and clients from being forgotten about. Granted, outside of a picnic thrown for long-term clients, it is unlikely that you’ll ever hear a client utter the words “Where’s the beef?” However, with a process like this in place, you hopefully also won’t ever hear something similar, something like “How the heck did that happen?”.

Mark Bassingthwaighte, Esq., serves as Risk Manager at ALPS, a leading provider of insurance and risk management solutions for law firms. Since joining ALPS in 1998, Mark has worked with more than 1200 law firms nationwide, helping attorneys identify vulnerabilities, strengthen firm operations, and reduce professional liability risks. He has presented over 700 continuing legal education (CLE) seminars across the United States and written extensively on the topics of risk management, legal ethics, and cyber security. A trusted voice in the legal community, Mark is a member of the State Bar of Montana and the American Bar Association and holds a J.D. from Drake University Law School. His mission is to help attorneys build safer, more resilient practices in a rapidly evolving legal environment.

.jpeg)

Some people seem to struggle when it comes to saying no. Perhaps they view it as requiring them to be confrontational and confronting someone can be...

An estate planning firm asked me to review several sample Consent to Joint Representation forms they were using with their clients; and what I found...

4 min read

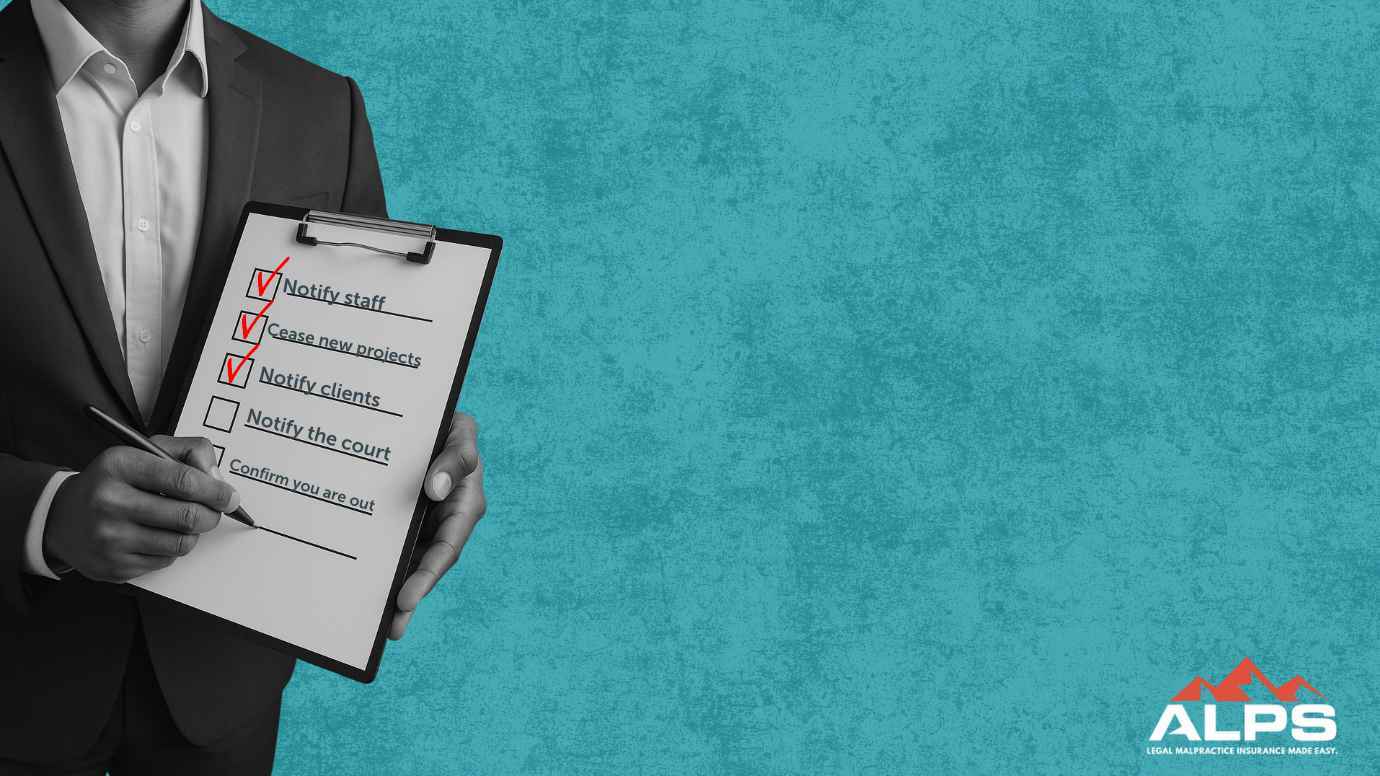

Common reasons lawyers close their practices include a medical disability, wanting to retire, a move out-of-state, or a career change. While the...